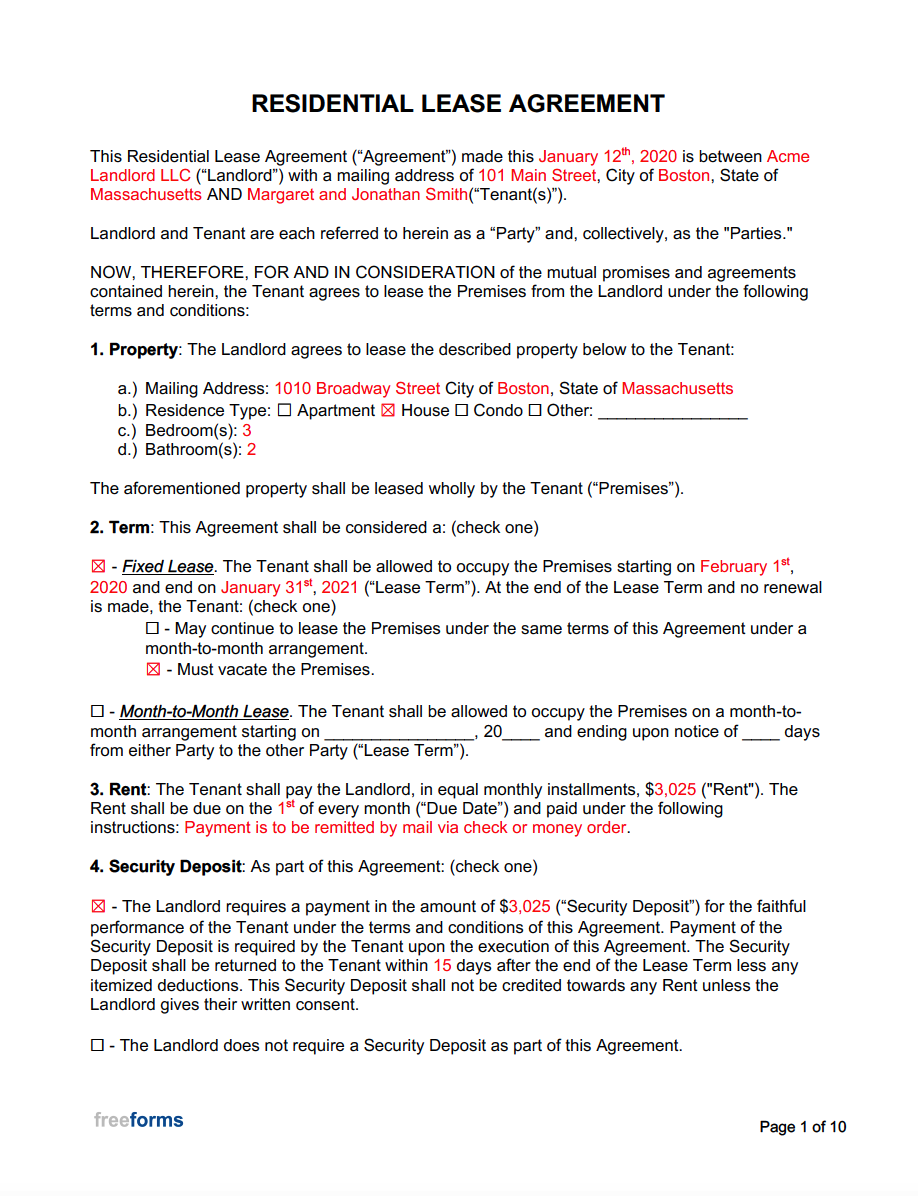

A lease agreement allows a tenant to occupy space in exchange for the payment of rent to the landlord. Prior to authorizing a lease, the landlord may request the tenant’s credit and background information to ensure they can afford the rent amount.

In addition, the landlord may require a security deposit which will typically be equal to one (1) or two (2) months’ rent in case the tenant does not fulfill their obligations under the agreement. Payment is commonly due on the first (1st) of the month with late fees or eviction proceedings that may commence if the tenant is late.

Rental Application – Use by a landlord to screen qualified tenants prior to a lease commitment.

Apartment Lease Agreement – A residence located in a multi-family building/structure. Unless the apartment is located on the first (1st) floor, there are no requirements for the tenant to maintain the premises.

Commercial Lease Agreement – The leasing of property for business-related use. This may be for any retail, office, or industrial purpose.

Condominium Lease Agreement – If the property for rent is under the rules and regulations of a condominium association, the owner of the unit may carry out this form with the prospective tenant.

Equipment Lease Agreement – The renting of an item (or items) for personal or work use.

House Lease Agreement – The rental of a single-family dwelling that is not part of a larger project.

Month-to-Month Lease Agreement – Known as a “tenancy-at-will”, this allows the landlord and tenant to come to an agreement on a property rental that can be canceled at any time (thirty (30) days’ notice is typically required).

Rent-to-Own Lease Agreement – When the tenant rents a property with the option to purchase the home during the course of the tenancy.

Room Rental (Roommate) Lease Agreement – For a person seeking to rent a room in a shared residence.

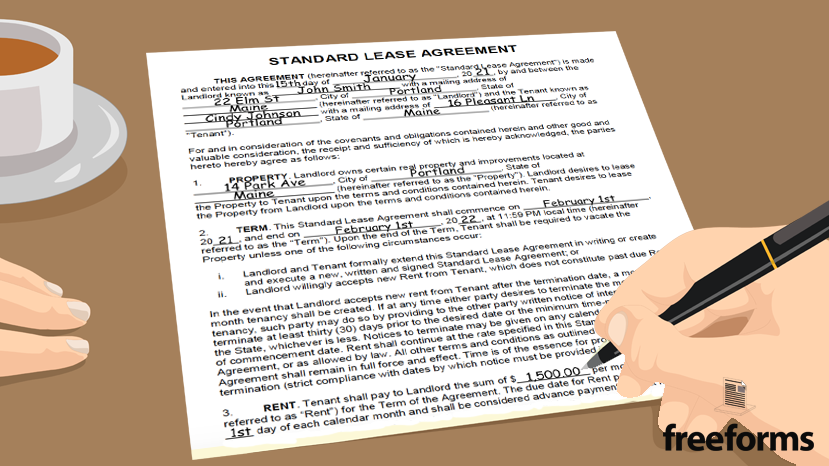

Standard Lease Agreement – Considered the paradigm of lease agreements, this document is commonly used for everyday rental transactions.

Sublease Agreement – For a tenant seeking to re-rent their residence to someone else (the “subtenant”). The landlord will commonly have to give consent as most standard lease agreements prohibit the act of subleasing.

A lease agreement is a common legal document that allows a person or business to rent property from the owner. Most residential agreements are for one (1) year, while most commercial agreements are usually for multiple years. The primary details of a lease that must be recorded within the form include:

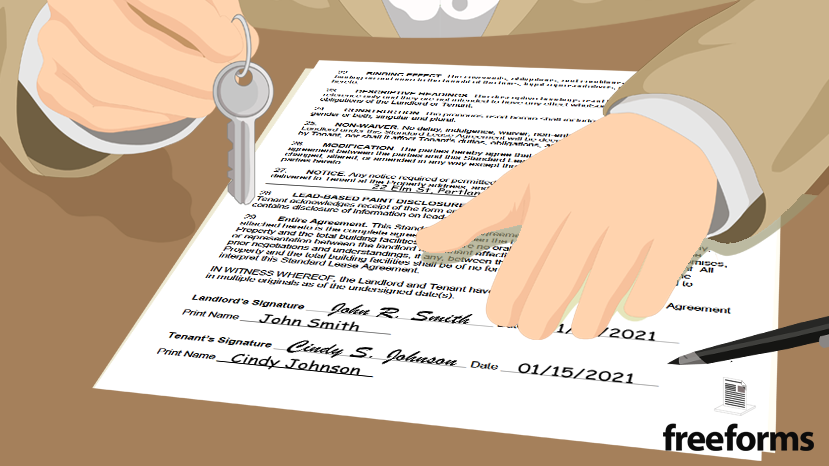

Once a lease agreement is signed by both parties, it becomes a legally binding document. (There is no need for witnesses or notarization.)

An addendum is attached to a lease to add supplementary terms to the existing contract. It is important that all parties (landlord & tenant) sign off on the document to ensure that they both acknowledge the modifications made.

A disclosure is a statement that relays specific information to the recipient (typically the tenant) concerning the rental property. Most times, these are presented because either local or federal laws require it.

General Addendums, Disclosures, & Notices:

If you are new to owning property or becoming a landlord, you will need to know the ins and outs of the lease agreement pretty well. For professional help, it’s best to hire a landlord & tenant attorney to draft a lease agreement for your property. If you wish to rent out your property yourself and would like to draft your own lease agreement, follow the steps below.

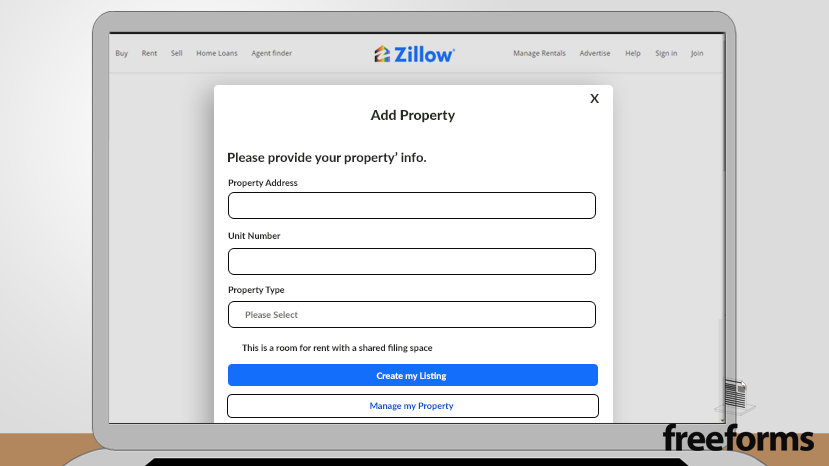

In order to attract interested parties, you have to make the public aware that you have a home available for rent (whether it be an apartment, condo, house, etc.). The most effective way to do this these days would be to advertise on a popular real estate listings website. The top platforms being:

Now that you have advertised your rental, it is only a matter of time before you will start to receive inquires regarding the property. Eventually, one of these parties will request to view the space in person to see if the home fits their needs. Schedule a time and date to have the property shown by you (the landlord) or an agent working on your behalf (realtor or property manager).

If any of the individuals viewing the premises convey that they are interested in leasing the residence, a rental application should be presented at this time to first verify their qualifications as a tenant. A rental application is a document that requires specifics concerning the prospective tenant’s current financial status (particularly regarding their income and credit score), past rental arrangements, and criminal background. The information is then analyzed to help determine whether or not they are a viable applicant. (A fee is commonly required for the tenant to compensate for the cost of processing the information.)

Once the landlord has found a tenant that has satisfied the application process, it will be time to introduce the lease agreement into the equation. Any tenants, also known as lessees, that will be living on the property need to be included in the lease agreement. The same goes for the landlord (or landlords if there are multiple owners), also called the lessor, who controls the rental property. Supplying the information of the lessee and lessor should be the very first part of the agreement. This just entails that the participants provide:

Within the terms of the lease is where you will establish the core elements of the tenancy. The following terms must be discussed, agreed upon, and entered into the form:

Both parties should review all the various clauses within the lease agreement that define the proper code of conduct for the rental property. Each clause contains language that dictates the rules & regulations that the landlord and tenant must adhere to in order to maintain a valid contract. When a rule or provision is broken, the violating party is considered in “breach of contract” and the other party may have the right to terminate the agreement if the infraction is not addressed within the allotted timeframe. Certain sections may be removed or added to the document to better serve the needs of each party. Some components of the occupancy that you may want to cover within this section include:

After establishing the terms & conditions of the tenancy and recording them within the form, it is essential that both parties supply their endorsements within the necessary areas of the contract. Many landlords/management companies utilize an online signing feature to perform signatures. Once signed, each party should retrieve a copy for their records and the occupancy shall start on the date issued within the contract. (This does not typically require notarization.)

Each state within the U.S. has its own rules and regulations regarding landlord-tenant relationships. Refer to the table below to find out more information about your state’s rental laws.

| STATE | AGREEMENT | LAWS |

|---|---|---|

| Alabama | Lease Agreement | Title 35, Chapter 9A (Uniform Residential Landlord and Tenant Act) |

| Alaska | Lease Agreement | Alaska Uniform Residential Landlord & Tenant Act (§ 34.03.010 – 34.03.360) |

| Arizona | Lease Agreement | Arizona Residential Landlord and Tenant Act |

| Arkansas | Lease Agreement | Chapter 17 – Arkansas Residential Landlord/Tenant Act |

| California | Lease Agreement | Guide to Residential Tenants’ and Landlords’ Rights and Responsibilities |

| Colorado | Lease Agreement | Landlord/Tenant Rights |

| Connecticut | Lease Agreement | Title 47a – Landlord and Tenant |

| Delaware | Lease Agreement | Title 25: Property – Part III – Residential Landlord-Tenant Code |

| Florida | Lease Agreement | Title VI, Chapter 83: Landlord and Tenant – Part II – Residential Tenancies |

| Georgia | Lease Agreement | Title 44: Chapter 7 – Landlord and Tenant |

| Hawaii | Lease Agreement | Chapter 521 (Residential Landlord-Tenant Code) |

| Idaho | Lease Agreement | Landlord and Tenant Manual |

| Illinois | Lease Agreement | Landlord and Tenant Act (765 ILCS § 705) |

| Indiana | Lease Agreement | Landlord-Tenant Relations (IC 32-31) |

| Iowa | Lease Agreement | Chapter 562A (Uniform Residential Landlord and Tenant Law) |

| Kansas | Lease Agreement | Chapter 25: Landlords and Tenants |

| Kentucky | Lease Agreement | Chapter 383 – Landlord and Tenant |

| Louisiana | Lease Agreement | Louisiana Revised Statutes – Landlord and Tenant ( § 9:3200 – § 9:3261) |

| Maine | Lease Agreement | Title 14, Chapter 710: Rental Property |

| Maryland | Lease Agreement | Title 8 – Landlord and Tenant |

| Massachusetts | Lease Agreement | Chapter 186: Estates for Years and at Will/Landlord-Tenant Law |

| Michigan | Lease Agreement | Chapter 554: Real and Personal Property |

| Minnesota | Lease Agreement | Chapter 504B: Landlord and Tenant Relations |

| Mississippi | Lease Agreement | Chapter 7 – Landlord and Tenant (§ 89-7-1 — 89-7-125) & Chapter 8 – Landlord and Tenant Act (§ 89-8-1 – 89-8-29) |

| Missouri | Lease Agreement | Landlord and Tenant (§ 441) & Landlord-Tenant Actions (§ 535) |

| Montana | Lease Agreement | Title 70, Chapter 24: Residential Landlord and Tenant Act of 1977 |

| Nebraska | Lease Agreement | Nebraska Uniform Residential Landlord and Tenant Act ( § 76.1401 – § 76.14,111) |

| Nevada | Lease Agreement | Chapter 118 – Discrimination in Housing; Landlord and Tenant & Chapter 118A – Landlord and Tenant: Dwellings |

| New Hampshire | Lease Agreement | Chapter 540: Action Against Tenants (§ 540-1) |

| New Jersey | Lease Agreement | Department of Community Affairs: Landlord-Tenant Information |

| New Mexico | Lease Agreement | New Mexico Renter’s Guide – A Handbook for Tenants and Landlords |

| New York | Lease Agreement | Landlord and Tenant (§ 220 – 238-A) |

| North Carolina | Lease Agreement | Landlord and Tenant (§ 42) |

| North Dakota | Lease Agreement | Leasing of Real Property (§ 47-16) |

| Ohio | Lease Agreement | Chapter 5321: Landlords and Tenants |

| Oklahoma | Lease Agreement | Title 41: Landlord and Tenant |

| Oregon | Lease Agreement | Chapter 90 – Residential Landlord and Tenant |

| Pennsylvania | Lease Agreement | The Landlord and Tenant Act of 1951 |

| Rhode Island | Lease Agreement | Residential Landlord and Tenant Act ( § 34-18 ) |

| South Carolina | Lease Agreement | Residential Landlord and Tenant Act ( § 27-40) |

| South Dakota | Lease Agreement | Lease of Real Property ( § 43-32) |

| Tennessee | Lease Agreement | Tennessee Uniform Residential Landlord and Tenant Act (§ 66-28-101 – 66-28-521) |

| Texas | Lease Agreement | Texas Property Code – Landlord and Tenant ( §8. 91.001) |

| Utah | Lease Agreement | Utah Code, Title 57: Real Estate |

| Vermont | Lease Agreement | Residential Rental Agreements (9 V.S.A. § 4451 – 4469a) |

| Virginia | Lease Agreement | Chapter 13: Resident Landlord and Tenant Act (§ 55-217 – § 55-248) |

| Washington | Lease Agreement | Residential Landlord-Tenant Act ( § 59.18) |

| West Virginia | Lease Agreement | Chapter 37, Article 6: Landlord and Tenant |

| Wisconsin | Lease Agreement | Chapter 704: Landlord and Tenant |

| Wyoming | Lease Agreement | Article 12 – Residential Rental Property Act (§ 1-21-1201 — 1-21-1211) |

Within all lease agreements, there will be a provision made stipulating the date in which the monthly rent payment is to be paid upon. States across the country have different laws that are enforceable should the tenant fail to pay the rent on time. These laws are mostly related to grace periods and fees.

A grace period is the duration of time the landlord has to wait before they can charge the tenant for an overdue rent payment.

A late fee is a penalty charge imposed on the tenant for not cooperating with terms of the contract in regard to supplying the rent payment on time.

Below is a table listing each state’s laws concerning the minimum grace period a landlord must wait before billing the tenant and the maximum fee they can charge. (Landlords and tenants should always record this element of the tenancy within the content of the lease agreement.)

| STATE | MINIMUM GRACE PERIOD | MAXIMUM FEE | LAWS |

|---|---|---|---|

| Alabama | No Minimum | No Maximum | No Statutes |

| Alaska | No Minimum | No Maximum | No Statutes |

| Arizona | No Minimum | No Maximum | No Statutes |

| Arkansas | Five (5) Days | No Maximum | § 18-17-701(b) |

| California | No Minimum | No Maximum | No Statutes |

| Colorado | No Minimum | No Maximum | No Statutes |

| Connecticut | Nine (9) Days | Although there is no statute, the state’s research report insists that the charge should not exceed 5% of the monthly rent . | § 47a-15a |

| Delaware | Five (5) Days | 5% of the Monthly Rent | § 5501, § 5501(d) |

| Florida | No Minimum | No Maximum | No Statutes |

| Georgia | No Minimum | No Maximum | No Statutes |

| Hawaii | No Minimum | No Maximum | No Statutes |

| Idaho | No Minimum | No Maximum | No Statutes |

| Illinois | Five (5) Days | $20 or 20% (whichever is more) | 770 ILCS § 95/7.10(a), 770 ILCS § 95/7.10(c) |

| Indiana | No Minimum | No Maximum | No Statutes |

| Iowa | No Minimum | Properties with rent payments of $700 or less may only have a maximum late fee of $12 per day or $60 a month . Tenants with a rent that exceeds $700 may be charged a maximum fee of $20 per day or $100 per month . | § 562A.9(4) |

| Kansas | No Minimum | No Maximum | No Statutes |

| Kentucky | No Minimum | No Maximum | No Statutes |

| Louisiana | No Minimum | No Maximum | No Statutes |

| Maine | Fifteen (15) Days | 4% of the Monthly Rent | § 14-6028, § 14-6028 |

| Maryland | No Minimum | 5% of the Monthly Rent | § 8–208 |

| Massachusetts | Thirty (30) Days | No Maximum | § 186-15B |

| Michigan | No Minimum | No Maximum | No Statutes |

| Minnesota | No Minimum | 8% of the Monthly Rent | § 504B.177 |

| Mississippi | No Minimum | No Maximum | No Statutes |

| Missouri | No Minimum | No Maximum | No Statutes |

| Montana | No Minimum | No Maximum | No Statutes |

| Nebraska | No Minimum | No Maximum | No Statutes |

| Nevada | No Minimum | No Maximum | No Statutes |

| New Hampshire | No Minimum | No Maximum | No Statutes |

| New Jersey | Five (5) business days only for senior citizens receiving social security and individuals receiving disability or WorkFirst benefits. No minimum grace period for individuals who are not under these categories. | No Maximum | § 2A-42-6 |

| New Mexico | No Minimum | No Maximum | § 47-8-15 |

| New York | No Minimum | No Maximum | No Statutes |

| North Carolina | Five (5) Days | $15 or 5% of the Monthly Rent (Weekly rentals may charge a maximum fee of $4 or 5% of the periodic rental cost .) | § 42-46(a), § 42-46(a)(1), § 42-46(a)(2) |

| North Dakota | No Minimum | No Maximum | No Statutes |

| Ohio | No Minimum | No Maximum | No Statutes |

| Oklahoma | No Minimum | No Maximum | No Statutes |

| Oregon | Four (4) Days | The landlord may charge a flat fee that is deemed a “reasonable amount” in relationship to the current market. In addition, they can collect a daily fee that is 6% of the flat fee charged, or 5% of the total rent . | § 90.260(1)(a), § 90.260(2) |

| Pennsylvania | No Minimum | No Maximum | No Statutes |

| Rhode Island | No Minimum | No Maximum | No Statutes |

| South Carolina | No Minimum | No Maximum | No Statutes |

| South Dakota | No Minimum | No Maximum | No Statutes |

| Tennessee | Five (5) Days (If the final day of the grace period happens to land on a Sunday or holiday, there shall automatically be a one (1) day extension.) | 10% of the Monthly Rent | § 66-28-201(d) |

| Texas | No Minimum | No Maximum | No Statutes |

| Utah | No Minimum | No Maximum | No Statutes |

| Vermont | No Minimum | No Maximum | No Statutes |

| Virginia | No Minimum | No Maximum | No Statutes |

| Washington | No Minimum | $20 or 20% of the Monthly Rent | § 19.150.150 |

| West Virginia | No Minimum | No Maximum | No Statutes |

| Wisconsin | No Minimum | No Maximum | No Statutes |

| Wyoming | No Minimum | No Maximum | No Statutes |

An NSF (non-sufficient funds) check occurs when someone provides a check that bounces. A lack of the needed funds in the account when the payment is attempting to be cashed will result in the financial institution charging the depositor a fee for the failed transfer. As a result of this, the landlord may be entitled to charge the tenant for any fees they incurred and the overall hassle.

Like late rent payments, many states enact laws that limit the amount one can charge for this violation. Either way, this fee should be established within the content of the rental agreement prior to its execution. If you are interested in researching your state’s policies on returned checks, review the table below to better understand your rights concerning this matter.

| STATE | MAXIMUM FEE | LAWS |

|---|---|---|

| Alabama | $30 | § 8-8-15(b) |

| Alaska | $30 | § 09.68.115(2) |

| Arizona | No Maximum | No Statutes |

| Arkansas | $30 | § 5-37-307, § 5-37-304 |

| California | $25 (Plus $35 for each additional bad check provided.) | § 1719 |

| Colorado | $20 | § 13-21-109 |

| Connecticut | No Maximum | § 52-565a(d) |

| Delaware | $40 | § 1301A |

| Florida | $25 for checks of $50 or less. $30 for checks more than $50, but less than $300. $40 for checks more than $300, or 5% of its total value. | § 68.065 |

| Georgia | $30 or 5% of the Check’s Amount | § 13-6-15 (b) |

| Hawaii | No Maximum | No Statutes |

| Idaho | If the parties cannot come to an agreement on the penalty for a returned check, then the landlord may take the tenant to court for the amount of the check plus $100 for damages, or 3 times the check’s amount. | § 1-2301A |

| Illinois | The amount of the check plus any fees incurred. | 720 ILCS § 5/17-1(E) |

| Indiana | $27.50 or 5% of the Check’s Amount | § 35-43-5-5 |

| Iowa | The amount of the check plus any fees incurred. | § 714.1(6) |

| Kansas | $30 | § 60-2610 |

| Kentucky | $50 | § 514.040 |

| Louisiana | $15 plus any fees charged by the financial institution. | § 14:71 |

| Maine | The landlord may charge for the amount of the check, bank fees, and mailing expenses. | § 14-6071 |

| Maryland | No Maximum | No Statutes |

| Massachusetts | $30 | § 62C-35 |

| Michigan | $25 for checks repaid within 7 days, $35 for checks repaid within 30 days. | § 600.2952 |

| Minnesota | No Maximum | No Statutes |

| Mississippi | $30 | § 97-19-75 |

| Missouri | $25 | § 570.120 |

| Montana | $30 | § 27-1-717 |

| Nebraska | $10 | § 28-611 |

| Nevada | No Maximum | No Statutes |

| New Hampshire | No Maximum | § 638-4 |

| New Jersey | Should the landlord not be compensated within 35 days of trying to cash the bad check, they may impose a fee of $100 or 3 times the amount on the check. | § 2A-32A-1 |

| New Mexico | No Maximum | No Statutes |

| New York | $20 | § 5-328 |

| North Carolina | $25 | § 25-3-506 |

| North Dakota | $40 | § 6-8-16.2a |

| Ohio | $30 or 10% of the Check’s Amount | § 1319.16 |

| Oklahoma | No Maximum | No Statutes |

| Oregon | $35 | § 30.701 |

| Pennsylvania | $50 | § 18.4105e |

| Rhode Island | $25 | § 6-42-3 |

| South Carolina | $30 | § 34-11-70 |

| South Dakota | $40 | § 57A-3-421 |

| Tennessee | $30 | § 47-29-102 |

| Texas | No Maximum | No Statutes |

| Utah | $20 | § 7-15-2 |

| Vermont | $5 | § 2022 |

| Virginia | $50 | § 8.01-27.1 |

| Washington | $40 | § 62A.3-515(b)(1) |

| West Virginia | $25 | § 61-3-39e |

| Wisconsin | No Maximum | No Statutes |

| Wyoming | $30 | § 1-1-115 |

A security deposit is charged by almost every landlord/owner that is renting out property. A security deposit is normally equal to one (1) or two (2) months’ rent depending on the tenant’s credit report, rental history, and state laws. If a tenant damages the dwelling or abandons the lease during the tenancy, the deposit is there to cover any losses incurred by the landlord. If there was no damage to the property and the lease ends, landlords will have a certain timeframe set by the state to return the full security deposit back to the tenant. If there was damage, then the landlord must include an itemized list of repairs that need to be made and deducted from the deposit.

Security Deposit Return/Refund Letter – Landlords may utilize this form for the purpose of documenting the reimbursement of the security deposit funds.

Review the data below to discover your state’s policies on the maximum amount a landlord can charge a tenant for the security deposit and the timeframe in which they must return the deposit upon the lease’s expiration.

| STATE | MAXIMUM | RETURN | LAWS |

|---|---|---|---|

| Alabama | One (1) Month’s Rent | Sixty (60) Days | § 35-9A-201(a), § 35-9A-201(b) |

| Alaska | Two (2) Months’ Rent (with the exception of properties that have a rent higher than $2,000) | Fourteen (14) Days | § 34.03.070(a), § 34.03.070(g) |

| Arizona | One and a Half (1.5) Months’ Rent | Fourteen (14) Days | § 33-1321(A), § 33-1321(D) |

| Arkansas | Two (2) Months’ Rent (Only for landlords who own six (6) or more rental units.) | Sixty (60) Days | § 18-16-304, § 18-16-305 |

| California | Two (2) Months’ Rent | Twenty-One (21) Days | § 1950.5(c), § 1950.5(g) |

| Colorado | No Maximum | Sixty (60) Days | § 38-12-103 |

| Connecticut | Two (2) months’ rent for individuals under 62 years old, one (1) month’s rent for individuals over the age of 62. | Thirty (30) Days | § 47a-21(b), § 47a-21(d)(2) |

| Delaware | One (1) Month’s Rent | Twenty (20) Days | § 5514, § 5514(e) |

| Florida | No Maximum | Fifteen (15) Days | § 83.49 |

| Georgia | No Maximum | Thirty (30) Days | § 44-7-34 |

| Hawaii | One (1) Month’s Rent | Fourteen (14) Days | § 521-44(b), § 521-44(c) |

| Idaho | No Maximum | Thirty (30) Days | § 6-321 |

| Illinois | No Maximum | Forty-Five (45) Days | 765 ILCS § 710/1(a) |

| Indiana | No Maximum | Forty-Five (45) Days | § 32-31-3-12 |

| Iowa | Two (2) Months’ Rent | Thirty (30) Days | § 562A.12(1), § 562A.12(3)(a) |

| Kansas | One (1) month’s rent for unfurnished properties, one and a half (1.5) months’ rent for furnished properties. | Fourteen (14) days if deductions are made, thirty (30) days for the full deposit. | § 58-2550(a), § 58-2550(b) |

| Kentucky | No Maximum | Sixty (60) Days | § 383.580 |

| Louisiana | No Maximum | One (1) Month | § 9:3251 |

| Maine | Two (2) Months’ Rent | Thirty (30) Days | § 6032, § 6033 |

| Maryland | Two (2) Months’ Rent | Forty-Five (45) Days | § 8-203(b)(1), § 8-203(e)(1) |

| Massachusetts | One (1) Month’s Rent | Thirty (30) Days | § 186-15B(1)(b)(iii), § 186-15B(4) |

| Michigan | One and a Half (1.5) Months’ Rent | Thirty (30) Days | § 554.602, § 554.609 |

| Minnesota | No Maximum | Twenty-One (21) Days | § 504B.178 |

| Mississippi | No Maximum | Forty-Five (45) Days | § 89-8-21 |

| Missouri | Two (2) Months’ Rent | Thirty (30) Days | § 535.300(1), § 535.300(3) |

| Montana | No Maximum | Ten (10) days for the full deposit, thirty (30) days for a partial deposit & itemized list of damages. | § 70-25-202 |

| Nebraska | One (1) Month’s Rent | Fourteen (14) Days | § 76-1416(1), § 76-1416(2) |

| Nevada | Three (3) Months’ Rent | Thirty (30) Days | § 118A.242(1), § 118A.242(4) |

| New Hampshire | One (1) Month’s Rent | Thirty (30) Days | § 540-A:6, § 540-A:7 |

| New Jersey | One and a Half (1.5) Months’ Rent | Thirty (30) Days | § 46-8-21.2, § 46-8-21.1 |

| New Mexico | There is no restriction on the amount a landlord can charge for a security deposit as long as it is deemed “ reasonable “. If the lessor would like to avoid paying the tenant interest, one (1) month’s rent is the maximum deposit that can be charged. One (1) month’s rent is also the maximum one can charge for rentals with a term of less than a year. | Thirty (30) Days | § 47-8-18(A)(1 & 2), § 47-8-18(C) |

| New York | No Maximum | Fourteen (14) Days | § 7-108(e) |

| North Carolina | Two (2) months’ rent for an annual lease, one (1) month’s rent for a month-to-month contract, and two (2) weeks’ rent for a week-to-week rental. | Thirty (30) days for a full deposit, sixty (60) days if deductions need to made due to damages. | § 42-51, § 42-52 |

| North Dakota | One (1) Month’s Rent (Individuals who have been convicted of a felony or violated the terms of a previous rental contract are subject to an increased security deposit of two (2) months’ rent .) | Thirty (30) Days | § 47-16-07.1(2)(A), § 47-16-07.1(3) |

| Ohio | No Maximum | Thirty (30) Days | § 5321.16.B |

| Oklahoma | No Maximum | Forty-Five (45) Days | § 41.115b |

| Oregon | No Maximum | Thirty-One (31) Days | § 90.300 |

| Pennsylvania | Two (2) Months’ Rent | Thirty (30) Days | § 68.250.511, § 68.250.512 |

| Rhode Island | One (1) Month’s Rent | Twenty (20) Days | § 34-18-19a, § 34-18-19b |

| South Carolina | No Maximum | Thirty (30) Days | § 34-11-410a |

| South Dakota | One (1) Month’s Rent | Two (2) Weeks | § 43-32-6.1, § 43-32-24 |

| Tennessee | No Maximum | Thirty (30) Days | § 66-28-301 |

| Texas | No Maximum | Thirty (30) Days | § 8 .92.103 |

| Utah | No Maximum | Thirty (30) Days | § 7-17-3 |

| Vermont | No Maximum | Fourteen (14) Days ( Sixty (60) days for seasonal rentals.) | § 4461c |

| Virginia | Two (2) Months’ Rent | Forty-Five (45) Days | § 55.1-1226(A), § 55.1-1226(A)(iv) |

| Washington | No Maximum | Twenty-One (21) Days | § 5 9.18.280 |

| West Virginia | No Maximum | As soon as “reasonably” possible. | § 37-6A-2 |

| Wisconsin | No Maximum | Twenty-One (21) Days | § 704.28 |

| Wyoming | No Maximum | Thirty (30) Days | § 1-21-1208 |

At some point during a tenant’s occupancy, there will be a time when the landlord (or their agent) needs to access the premises for essential purposes, e.g. repairs, general maintenance, emergencies, etc. All contracts for the rental of residential property should include a clause that lays down the protocol for this situation, as there is a certain etiquette that is expected in order to respect the tenant’s rightful boundaries and allow them time to prepare for the entry.

A notice of entry should be delivered to the tenant informing them that the landlord (or an individual working on their behalf) will need access to the unit. This notice must be provided with a “reasonable” date & time of arrival as well as a purpose for the visit. It is important to stipulate the minimum required hours/days of notice within the lease agreement prior to the tenancy. Before selecting the desired amount of advanced notice required to enter the property, individuals should first verify their local state laws concerning this issue.

| STATE | MINIMUM NOTICE | LAWS |

|---|---|---|

| Alabama | Two (2) Days | § 35-9A-303 (c) & (d) |

| Alaska | Twenty-Four (24) Hours | § 34.03.140(c) |

| Arizona | Two (2) Days | § 33-1343(D) |

| Arkansas | No Minimum | No Statute |

| California | Twenty-Four (24) Hours | § 1954(a) |

| Colorado | No Minimum | No Statute |

| Connecticut | “Reasonable Notice” | § 47a-16(c) |

| Delaware | Forty-Eight (48) Hours | § 5509(b) |

| Florida | Twelve (12) Hours | § 83.53(2) |

| Georgia | No Minimum | No Statute |

| Hawaii | Two (2) Days | § 521-53(b) |

| Idaho | No Minimum | No Statute |

| Illinois | No Minimum | No Statute |

| Indiana | “Reasonable Notice” | § 32-31-5-6(g) |

| Iowa | Twenty-Four (24) Hours | § 562A.19(3) |

| Kansas | “Reasonable Notice” | § 58-2557 |

| Kentucky | Forty-Eight (48) Hours | § 383.615 |

| Louisiana | No Minimum | No Statute |

| Maine | Twenty-Four (24) Hours | § 14-6025 |

| Maryland | No Minimum | No Statute |

| Massachusetts | No Minimum | No Statute |

| Michigan | No Minimum | No Statute |

| Minnesota | “Reasonable Notice” | § 504B.211 |

| Mississippi | No Minimum | No Statute |

| Missouri | No Minimum | No Statute |

| Montana | Twenty-Four (24) Hours | § 70-24-312 |

| Nebraska | Twenty-Four (24) Hours | § 76-1423 |

| Nevada | Twenty-Four (24) Hours | § 118A.330 |

| New Hampshire | No Minimum | No Statute |

| New Jersey | No Minimum | No Statute |

| New Mexico | Twenty-Four (24) Hours | § 47-8-24 |

| New York | No Minimum | No Statute |

| North Carolina | No Minimum | No Statute |

| North Dakota | No Minimum | No Statute |

| Ohio | Twenty-Four (24) Hours | § 5321.04.8 |

| Oklahoma | Twenty-Four (24) Hours | § 41.128 |

| Oregon | Twenty-Four (24) Hours | § 90.322 |

| Pennsylvania | No Minimum | No Statute |

| Rhode Island | Forty-Eight (48) Hours | § 34-18-26 |

| South Carolina | Twenty-Four (24) Hours | § 27-40-530a |

| South Dakota | Twenty-Four (24) Hours | § 43-32-32 |

| Tennessee | No Minimum | No Statute |

| Texas | No Minimum | No Statute |

| Utah | Twenty-Four (24) Hours | § 57-22-4 |

| Vermont | Forty-Eight (48) Hours | § 4460 |

| Virginia | Twenty-Four (24) Hours | § 55-248.18 |

| Washington | Twenty-Four (24) Hours | § 5 9.18.150 |

| West Virginia | No Minimum | No Statute |

| Wisconsin | Twelve (12) Hours | § 134.09(2)(a)(2) |

| Wyoming | No Minimum | No Statute |

Listed below are some commonly used words/phrases associated with leasing (in alphabetical order):

Abandonment – When the tenant unexpectedly vacates the premises prior to fulfilling the terms of the agreement.

Addendum – A supplementary form that may be attached to a lease to include additional terms (must be signed by both parties to take effect).

Agent – Somebody who works on the behalf of another, e.g. real estate agent, attorney, property manager, etc.

Alterations & Improvements – Modifications made to a property that changes its physical appearance or functionality.

Appliances – Devices/Machines that perform household duties and typically tend to be large, e.g. laundry machines, refrigerators, dishwashers, stoves/ovens, etc. (These items are most times considered to be fixtures to the rental unit and labeled “real property”.)

Amenities – Additional features of a rental property that add extra value to it, e.g. balcony, washer/dryer, fitness center, etc.

Binding Effect – A widely used clause, this section of a lease agreement is implemented for the purpose of binding and benefiting the parties involved as well as their heirs, legal representatives, and assigns.

Breach of Contract – A violation of any of the terms & conditions recorded within the rental contract that may result in a termination of the agreement if the infringing party does not rectify the situation.

Default – The chain of events that are to occur should the tenant be in breach of contract.

Due Date – The day in which the rent payment is to be satisfied by the tenant. (Oftentimes, a grace period of several days is provided if the rent is not paid on the exact due date, after which, the landlord is entitled to charge a fee.)

Entire Agreement – A clause included within the lease used to signify that all the agreements made are contained within the document (and its attachments) and that no other arrangements were made separately.

Eviction – A formal action taken by the landlord to expel the tenant from the rental property.

Fair Housing Act – Restricts property owners (or their agents) from refusing to rent to an individual based on their race, sex, color, age, familial status, nationality, religion, or disability.

Fixed Term – Unlike a tenancy at will (a month-to-month contract) where you can end the lease at any time so long as the required amount of notice is given, a fixed-term lease is a specific span of time that the parties are obligated to carry out. This term could span from six (6) months to multiple years, but one (1) year is the most common option you will find with this type of tenancy.

Furnishings – Pieces of furniture, decor, and any other similar items that can be removed from the home and are considered personal property.

Governing Law – A common clause included within a lease agreement, this term conveys that the tenancy is subject to local state laws.

Grace-Period – A span of time from the day the rent is due in which the landlord must wait before he or she can charge a late fee. (The amount of time should be listed within the lease agreement and is typically around five (5) days.)

Guests – A guest is identified as a person who is not considered a tenant or occupant that will be present on the premises for a brief period of time. The amount of time a guest can stay should be stated within the rental contract. (Most leases will mandate that a particular guest cannot stay on the property for more than ten (10) to fourteen (14) days within a six (6) month period.)

Hazardous Materials – Any substances contained on the premises that could have a negative impact on the residents or the property itself.

House Rules – These are guidelines created by roommates to avoid any type of disputes regarding the co-tenancy. Some examples of what these guidelines could cover include cleaning duties, noise restrictions, guest privileges, etc.

Indemnification – A common clause contained within most lease agreements, this section is used to protect the landlord from any legal liability concerning the injury of any tenants or guests that may occur on the premises, as well as any damage to their personal property.

Insurance (Bond) – Landlords are encouraged (and sometimes demanded by local law) to notify the tenant of what type of insurance policy they have as it pertains to the lessee.

Landlord (Lessor) – Owner of the rental property who will be leasing the residence to the tenant (lessee).

Late Fee – A charge imposed by the landlord when the tenant has failed to satisfy the monthly cost of the rental on the date in which the rent is due. (Most rental agreements specify that the tenant has a certain amount of days from the due date, known as a grace period, to pay the rent.)

Lease Agreement (Rental Contract) – A document used to outline the terms & conditions of a tenancy which legally binds both parties to follow through with the arrangement once signed.

Lease Renewal – Renewing the terms of rental contract upon its expiration.

Maintenance – The periodic upkeep of a rental property that the tenant must be willing to accommodate.

Monthly Rent – The monthly payment required by the tenant for the use of the property, commonly owed on the first (1st) of every month.

Month-to-Month – Also known as a “Tenancy at Will” or a “Periodic Tenancy”, this type of term only lasts for about roughly thirty (30) days at a time. As you approach the expiration date of each term, it will automatically renew until canceled by either party. (Generally speaking, individuals can end the arrangement at any time given that thirty (30) days’ notice is delivered to the other party.)

Non-Delivery of Possession – A provision oftentimes added to a rental contract, this clause conveys what is to happen should the tenant not be able to move into the property by the commencement date.

Notice – A written notification letter typically sent by the landlord informing the tenant of an issue regarding the occupancy, e.g. notice of entry, notice to quit, notice of renovations, etc.

Occupants – Any individuals who will be residing within the premises who are not listed as a tenant on the lease agreement, e.g. partners, children, other family members, etc.

Parking – A clause customarily included within most lease agreements that establishes the property’s parking situation for tenants’ vehicles. (A fee may be recorded within this portion of the form should the landlord require compensation for the parking spot.)

Parties – All individuals taking part in the rental transaction, e.g. landlord(s) and tenant(s).

Payment Location – The address in which the tenant is obligated to deliver the sum of money for the periodic rental costs.

Personal Property – Unlike real property, these are items/belongings that can be removed from the premises and are not affixed, e.g. furniture, rugs, televisions (that are not mounted), etc.

Pet Deposit & Fee – An amount separate from the security deposit that is held by the landlord in case there is damage due to a domesticated animal living on the premises. Some owners may also add a monthly fee in order for the tenant to secure the right to have a pet reside within the rental unit.

Property Description – The physical address of the rental property, i.e. the street name & number, unit number, city, state, and zip code.

Property Manager – An individual who operates a rental property on behalf of the owner in exchange for compensation.

Prorated Rent – Oftimes utilized when there is a delay in the move-in date, the landlord may adjust the normal monthly payment to account for the days the tenant was unable to reside within the property. (In order to calculate how much each day costs, divide the rent payment by how many days there are in the month.)

Real Property – This term encompasses the land and all the property attached to it, i.e. the land, building(s), and any fixtures attached to the structure(s).

Receipt of Agreement – It is vital that both parties receive a copy of the lease upon its execution in order to legitimize the transaction. (This should include copies of any other related documents as well as receipts confirming that certain payments were made.)

Returned Check – Also referred to as a “bounced check” or “NSF check”, this occurs when a check is attempted to be cashed by the landlord but the account it is associated with has insufficient funds to satisfy the amount provided.

Security Deposit – A very common term in the rental world, this is a sum of money provided by the tenant prior to the move-in date in order to protect the landlord from incurring the cost of any damages that may occur during the term of the occupancy.

Security Deposit Refund – Upon the expiration of the lease agreement, the landlord is required to return the security deposit, minus the cost of any damages, to the tenant. (This should include a written breakdown showing any deductions taken from the full amount.)

Severability – This paragraph is incorporated into a lease agreement for the purpose of stating that if a singular provision is not legally valid, it shall not nullify any of the other provisions made within the contract.

Sublandlord (Sublessor) – The original tenant who will be re-renting the premises to the subtenant (sublessee).

Subleasing (Sub-Letting) – A type of arrangement where the current tenant of a property re-rents the premises to a third (3rd) party. (This may only occur if the official landlord of the property grants permission.)

Subtenant (Sublessee) – The individual who will be subleasing the property from the primary tenant.

Tenancy – A common word used to describe a lessee’s occupancy.

Tenant (Lessee) – The individual who will be renting the property from the landlord (lessor) and occupying the unit.

Term – The period of time in which the tenant has the right to occupy the property.

Terms & Conditions – Guidelines recorded within a contract that need to be complied with in order to maintain a valid agreement.

Use of Property – What will the property be utilized for? The property use of a residence will most likely have a clause stating that the property is to function only as a single-family dwelling, as opposed to accomodating a business operation.

Termination – The terminology used in the rental industry when a contract is ended, either because the agreement has expired and one of the parties does not want to renew, or because there was a violation of the terms & conditions.

Utilities – Specific services needed for a dwelling to be habitable, e.g. electric, gas, water, sewer, trash collection, etc.

Vacancy Rate – The number of vacant units versus the total number of units within a building.

Verbal Agreement – An arrangement that is vocalized between two (2) parties rather than written down. (It is not recommended to arrange any aspects of a tenancy this way, as it is hard to prove what the parties had spoken about.)

Breaking a lease could potentially come with some negative consequences, such as legal repercussions, difficulty renting in the future, and financial losses. When two (2) parties have signed a lease agreement, they are bound to uphold the provisions set forth within the contract. If you still want to follow through with breaking the lease, you may want to first see if there is a way out that does not violate any of the content written within the document. You may want to consider exploring the following avenues:

An active lease agreement where you are listed as a tenant can be considered “proof of residency” when presented to certain establishments. With that said, different states have different quotas for the amount of time that you have to be present within the boundaries of the state in order to be considered an official resident (typically around six (6) months out of the year).

Although it is much less common for a property to be occupied by a tenant without a lease, it is still something that occurs and has to be dealt with by landlords. Some examples of this could include the following:

If any of the aforementioned scenarios are applicable to you as a landlord and you would like to remove the tenant as soon as possible, consider some of the options regarding the eviction process listed below:

(Rules and regulations regarding evictions will vary from state to state. It is important that landlords research their local laws or hire legal counsel to advise them of their rights as a property owner.)

Depending on the current status of the marketplace, either the landlord or prospective tenant will have the upper hand when negotiating the terms of the rental contract. Listed below are some tools that can be implemented to increase your chances of achieving a beneficial transaction:

The answer to this question is subject to the content of the lease. Given this information, the landlord may have the following options:

But, if the agreement does not contain an out for the landlord and the tenant has held up their end of the bargain, the laws will protect the tenant and they will be able to continue residing within the property until the expiration of the contract.

The only possible way that a landlord would be able to change the terms of the rental contract after both parties have signed the document would be to create an addendum with the supplementary terms and have both parties sign the form. If the tenant doesn’t agree to the new terms and refuses to sign the addendum, then the landlord has no other option than to follow through with the conditions of the primary agreement.

This is the basic terminology used when entering into a lease agreement. Basically, the lessee is the tenant entering into the contract, and the lessor is landlord renting out the property. It is important to know these terms as they are prominently used in most contracts for the rental of a property.

Download: PDF, Word (.docx)